Helping You File For Debt Forgiveness

- Did you receive a 1099C for Cancellation of Debt?

- Did you know this might be Taxable?

- Are you Insolvent (unable to pay taxes owed) or do you plan to file Chapter 11 Bankruptcy?

Below are some of the circumstances where Cancellation of Debt Income/1099C can be excluded:

- If your debt is forgiven through a bankruptcy proceeding under Title 11 of the U.S. Code, the discharged amount is typically not considered taxable income.

- If you were insolvent (your total liabilities exceed your total assets) at the time the debt was forgiven, you might be able to exclude the canceled debt from your taxable income. However, the exclusion amount cannot exceed the amount by which you were insolvent.

- Discharged debt related to a farm operation might be excluded from taxable income if certain conditions are met. This exclusion is designed to assist farmers facing financial hardship.

- For non-C corporations, this exclusion applies to debt associated with real property used in a trade or business that is forgiven. Nevertheless, it’s important that the debt meets specific criteria to qualify for this exclusion.

- The QPRI exclusion, initially introduced as part of the Mortgage Forgiveness Debt Relief Act of 2007 and extended multiple times, enables taxpayers to exclude canceled debt related to their principal residence.

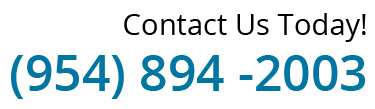

It’s crucial to understand the implications of a 1099-C and how it might affect your taxes. For this reason, consulting a tax professional or accountant is beneficial to navigate the complexities and potential exemptions related to cancellation of debt income. Without a doubt, you’ll save yourself a significant amount of money and stress by letting us handle your debt worries. Contact your Pembroke Pines CPA today.